The impact of electrification and new energy in the automotive industry on the traditional diesel automotive parts industry, as well as the prospects and opportunities for traditional diesel equipment

The rise of electrification and new energy vehicles (NEVs) is fundamentally transforming the automotive industry, with significant implications for the traditional diesel automotive parts sector. While this shift poses challenges, it also creates new opportunities for adaptation and growth. Here’s an analysis of the impact and future prospects:

Impact on the Traditional Diesel Automotive Parts Industry

Decline in Demand for Core Diesel Components

Parts like fuel injection systems, turbochargers, exhaust after-treatment systems (DPF, SCR), and engine blocks face reduced demand as EVs and hybrids gain market share.

Stricter emissions regulations (e.g., Euro 7, China VI) may accelerate the phase-out of diesel engines in passenger cars and light-duty vehicles.

Supply Chain Disruption

Many Tier 2 and Tier 3 suppliers specializing in diesel components may face consolidation or bankruptcy if they fail to pivot.

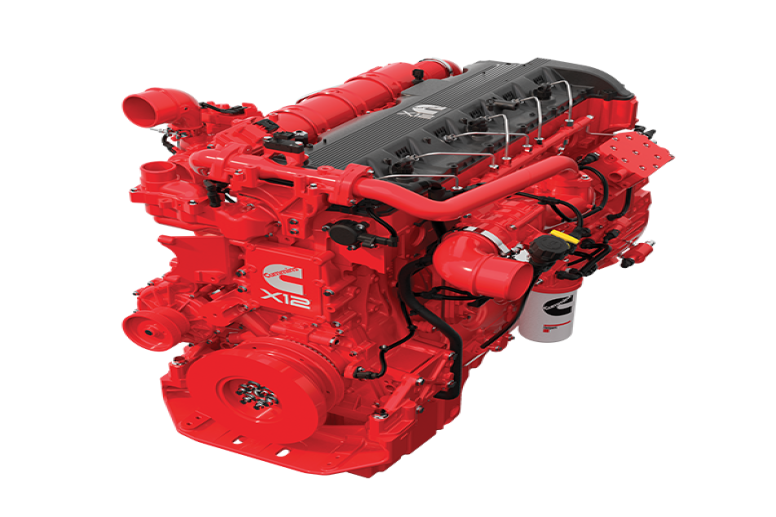

Traditional diesel engine manufacturers (e.g., Cummins, Bosch Diesel Systems) are already diversifying into electrification and hydrogen solutions.

Aftermarket Challenges

Reduced diesel vehicle sales will shrink the aftermarket for replacement parts (e.g., injectors, EGR valves).

However, legacy diesel fleets (trucks, construction equipment) will still require maintenance for years, sustaining some demand.

Prospects and Opportunities for Traditional Diesel Equipment

Despite the shift toward electrification, diesel technology will not disappear overnight. Key opportunities include:

1. Heavy-Duty and Off-Road Applications

Trucks, Construction, and Agriculture: Diesel remains dominant in heavy machinery due to high energy density and durability.

Marine and Mining: Electrification is slower here due to power and runtime requirements.

Opportunity: Suppliers can focus on high-efficiency, low-emission diesel innovations (e.g., hybrid diesel-electric systems).

2. Hybridization and Alternative Fuels

Diesel-Electric Hybrids: Many commercial vehicles are adopting hybrid systems, creating demand for optimized diesel components.

Hydrogen-Diesel Combustion: Some manufacturers are testing hydrogen-enhanced diesel engines to reduce emissions.

Biofuels & Synthetic Diesels: Renewable diesel (HVO) and biodiesel can extend the life of diesel engines in a decarbonizing world.

3. Retrofitting and Emission Upgrades

Older diesel fleets may need retrofits (e.g., upgraded DPFs, SCR systems) to meet emissions standards.

Emerging markets (Africa, South Asia) will continue using diesel vehicles longer, sustaining demand for parts.

4. Diversification into Electrification

Many traditional diesel suppliers (e.g., BorgWarner, Valeo) are shifting to EV components (e.g., inverters, battery cooling systems).

Opportunities in fuel cells (for hydrogen trucks) and electric drivetrains for commercial vehicles.

Conclusion: Adaptation is Key

The traditional diesel parts industry must pivot or perish. While demand will decline in passenger vehicles, opportunities remain in heavy-duty, hybrid, and emerging markets. Companies that invest in clean diesel tech, hybridization, and electrification will survive and thrive. The future is not the end of diesel but its evolution into a more sustainable role alongside new energy solutions.